In today’s digital age, applying for a business bank account online has become a convenient and efficient way for entrepreneurs to manage their finances. Gone are the days of lengthy paperwork and time-consuming visits to the bank. With an online application, you can open a business account from the comfort of your own home or office, saving valuable time and resources. This thorough guide will walk you through the process of applying for a business bank account online, highlighting the key requirements, steps, and tips to ensure a smooth and achievementful experience. Whether you’re a startup or an established company, understanding the ins and outs of online business banking is essential for managing your finances effectively. Let’s dive in and explore how you can leverage the power of online banking to streamline your business operations. The process of opening a business account has never been easier, thanks to the rise of online application platforms offered by various banks and financial institutions. This digital transformation has not only simplified the application process but has also offerd businesses with greater flexibility and accessibility to banking services. By choosing to apply for a business account online, entrepreneurs can avoid the traditional hassles associated with in-person applications, such as scheduling appointments, filling out extensive paperwork, and waiting in long queues. The online application process typically involves completing an online form, uploading the necessary documents, and submitting the application electronically. This streamlined approach saves time and effort, allowing business owners to focus on other critical facets of their operations. Furthermore, online business accounts often come with a scope of attributes and benefits tailored to meet the specific needs of businesses. These may include online bill payment, mobile banking, account alerts, and integration with accounting software. By leveraging these tools, businesses can gain better control over their finances, improve cash flow management, and make more informed financial decisions. In addition to the convenience and efficiency of online applications, many banks also offer rival interest rates and lower fees for online business accounts. This can outcome in significant cost savings for businesses, especially those that conduct a high volume of transactions. By comparing the offerings of varied banks, entrepreneurs can find the account that optimal suits their financial needs and objectives. Overall, applying for a business account online is a smart and practical choice for modern businesses. It offers a seamless and convenient way to manage finances, access banking services, and save time and money. By following the steps outlined in this guide, entrepreneurs can navigate the online application process with confidence and set their businesses up for financial achievement.

Why select an Online Business Account ?

Time is money, especially when you’re running a business. Online applications eliminate the need for in-person visits, allowing you to apply for a business account from the comfort of your home or office. This flexibility is invaluable for busy entrepreneurs who need to focus on growing their business. Plus, many online banks offer rival interest rates and lower fees compared to traditional brick-and-mortar institutions. This can translate to significant savings over time, boosting your bottom line.

Key Requirements for an Online Application

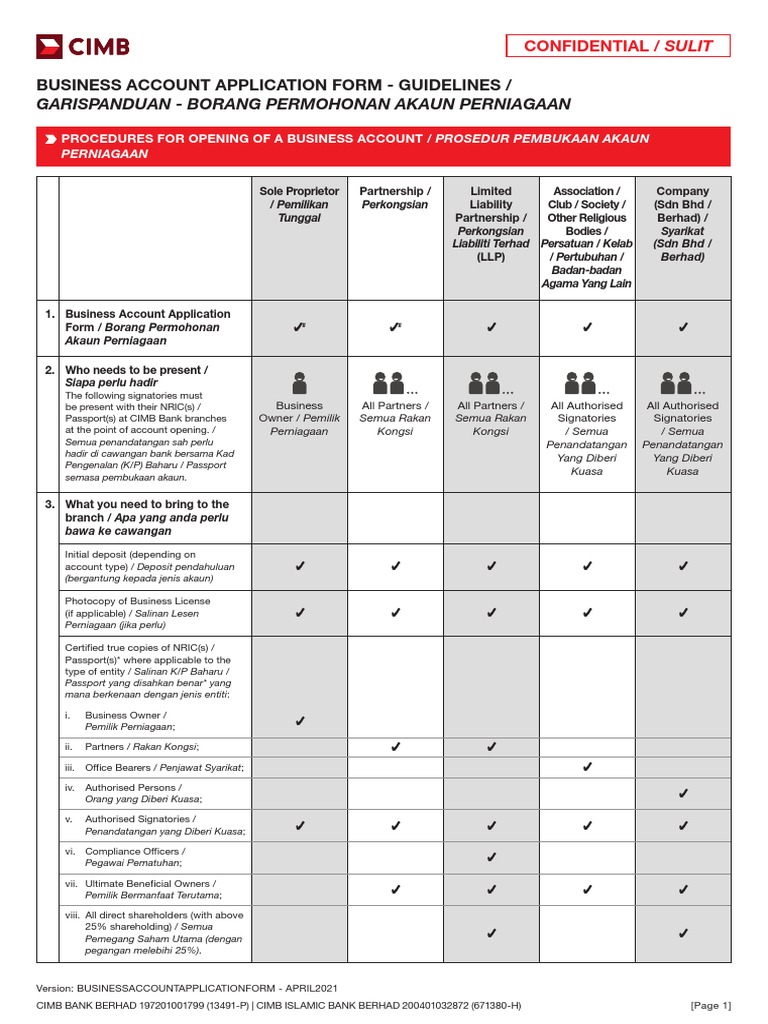

Before you start your online application, gather all the necessary documents. Typically, you’ll need your Employer Identification Number (EIN), business formation documents (such as articles of incorporation or organization), personal identification for all authorized signatories (driver’s license or passport), and proof of address for both the business and its owners. Some banks may also require a business plan or financial projections. Having these documents readily available will streamline the application process and prevent delays.

Related Post : apply online for business bank account

Step-by-Step Guide to Applying Online

1. study and Compare Banks: Start by studying varied banks that offer online business accounts. Look for institutions with a strong reputation, rival fees, and attributes that align with your business needs. Read customer reviews and compare interest rates to make an informed decision.

2. Visit the Bank’s Website: Once you’ve chosen a bank, visit their website and navigate to the business banking section. Look for the “Open an Account” or “Apply Now” button.

3. Complete the Online Application: Fill out the online application form accurately and completely. Be prepared to offer detailed information about your business, including its legal structure, industry, and annual revenue. Double-check all the information before submitting.

4. Upload Required Documents: Upload the required documents in the specified format. Ensure that the documents are clear and legible to avoid any processing delays.

5. Verification and Approval: After submitting your application, the bank will verify your information and conduct a background check. This process may take a few days to a few weeks, depending on the bank’s policies. You may be contacted for additional information or clarification.

6. Account Activation: Once your application is approved, you’ll receive instructions on how to activate your new business account. This may involve making an initial deposit or setting up online banking credentials.

Choosing the Right Bank Account for Your Business

Not all business bank accounts are created equal. Consider your business needs when choosing an account. If you handle a high volume of transactions, look for an account with unlimited transactions or low transaction fees. If you need access to cash, select a bank with a wide network of ATMs. Some banks also offer specialized accounts for specific industries, such as real estate or e-commerce. Evaluate your options carefully to find the optimal fit for your business.

Tips for a Smooth Online Application Process

- Ensure your business information is consistent across all documents.

- Use a secure internet connection when submitting your application.

- Read the fine print and understand the terms and conditions of the account.

- Keep a copy of your application and all supporting documents for your records.

- Contact the bank’s customer service if you have any querys or concerns during the application process.

Opening a business bank account online is a game-changer for modern entrepreneurs. It offers unparalleled convenience, saves valuable time, and offers access to a wider scope of banking options. By understanding the requirements, preparing your documents, and choosing the right bank, you can streamline your financial operations and set your business up for achievement. Embrace the digital age and unlock the benefits of online business banking today !