So, you love your furry, scaly, or feathered friend more than anything, right? You’d do anything for them. But what happens when they get sick or injured? Vet bills can be a real punch to the gut. That’s where pet insurance comes in. But with so many options out there, how do you select the best pet insurance? Let’s dive in and find out!

Why You Absolutely Need Pet Insurance. Seriously!

Let’s face it, vet bills can be astronomical. One unexpected surgery or chronic illness can wipe out your savings. Pet insurance acts as a safety net, helping you afford the best possible care for your pet without the financial stress. Think of it as an investment in your pet’s health and your own peace of mind. Plus, many policies cover things like accidents, illnesses, surgeries, and even some preventative care. It’s a win-win!

Decoding the Jargon: What Does Pet Insurance Actually Cover?

Not all pet insurance policies are created equal. Understanding the varied types of coverage is crucial. Accident-only plans are the most basic, covering injuries from accidents like broken bones or swallowed objects. Accident and illness plans offer broader coverage, including illnesses like cancer, diabetes, and infections. Some policies even include wellness coverage for routine checkups, vaccinations, and flea/tick prevention. Read the fine print carefully to understand what’s covered and what’s not. Pay attention to deductibles, co-pays, and annual limits.

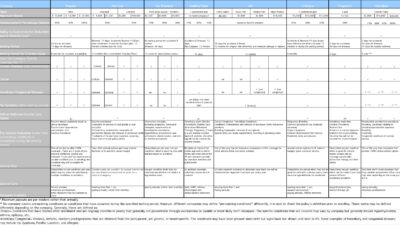

Top Contenders: A Look at the Best Pet Insurance offerrs.

Okay, so you’re convinced you need pet insurance. But where do you start? Several reputable companies offer thorough coverage. studying the best pet insurance companies is key. Some popular choices include Trupanion, Pets Best, Embrace, and Healthy Paws. Each company has its own strengths and weaknesses, so compare their policies, prices, and customer reviews. Consider factors like coverage options, waiting periods, claim processing speed, and customer service reputation. Don’t be afraid to get quotes from multiple offerrs to find the best fit for your needs and budget.

Finding the Perfect Fit: Factors to Consider When Choosing a Policy.

Choosing the right pet insurance policy is a personal decision. Consider your pet’s breed, age, and health history. Some breeds are predisposed to certain conditions, so you’ll want a policy that covers those potential issues. Older pets may have higher premiums, but they’re also more likely to need medical care. Think about your budget and how much you’re willing to spend on premiums each month. Also, consider the deductible and co-pay options. A higher deductible will lower your premium, but you’ll have to pay more out-of-pocket before your insurance kicks in. A lower deductible will outcome in a higher premium, but you’ll pay less out-of-pocket.

Related Post : amico life insurance

Real-Life Savings: How Pet Insurance Saved the Day (and My Wallet!).

Let me tell you a story. My golden retriever, Max, decided to eat a sock. Yes, a whole sock. It required emergency surgery to remove it, and the vet bill was over $3,000. Thankfully, I had pet insurance. I submitted a claim, and they reimbursed me for a significant portion of the cost. Without pet insurance, I would have been in serious financial trouble. This experience taught me the importance of being prepared for the unexpected. Pet insurance isn’t just a luxury; it’s a requirement for responsible pet owners.

Choosing the best pet insurance for your furry friend is a big decision. Take your time, compare policies, and read reviews. The peace of mind knowing you can offer the best care without breaking the bank is priceless. After all, they’re not just pets; they’re family!