In the intricate world of risk management, understanding insurance appetite is paramount. It’s the compass that guides businesses and individuals toward the right insurance coverage, ensuring they’re adequately protected against potential financial losses. But what exactly is insurance appetite, and how can you navigate it effectively? This guide will offer you with a thorough overview, equipping you with the knowledge and strategies to find the perfect insurance fit. Insurance, Appetite, Guide: These three words are your key to unlocking a world of tailored coverage and peace of mind.

Understanding Insurance Appetite: A thorough Guide. Insurance appetite, in its simplest form, refers to the types of risks that an insurance company is willing to insure. It’s a crucial idea for businesses and individuals seeking coverage, as it dictates which insurers are most likely to offer favorable terms and pricing. Think of it as an insurer’s ‘sweet spot’ – the types of risks they understand well and are comfortable taking on. Ignoring insurance appetite can lead to wasted time, declined applications, and ultimately, inadequate coverage. This guide will delve into the intricacies of insurance appetite, providing you with the knowledge and tools to navigate this complex landscape effectively.

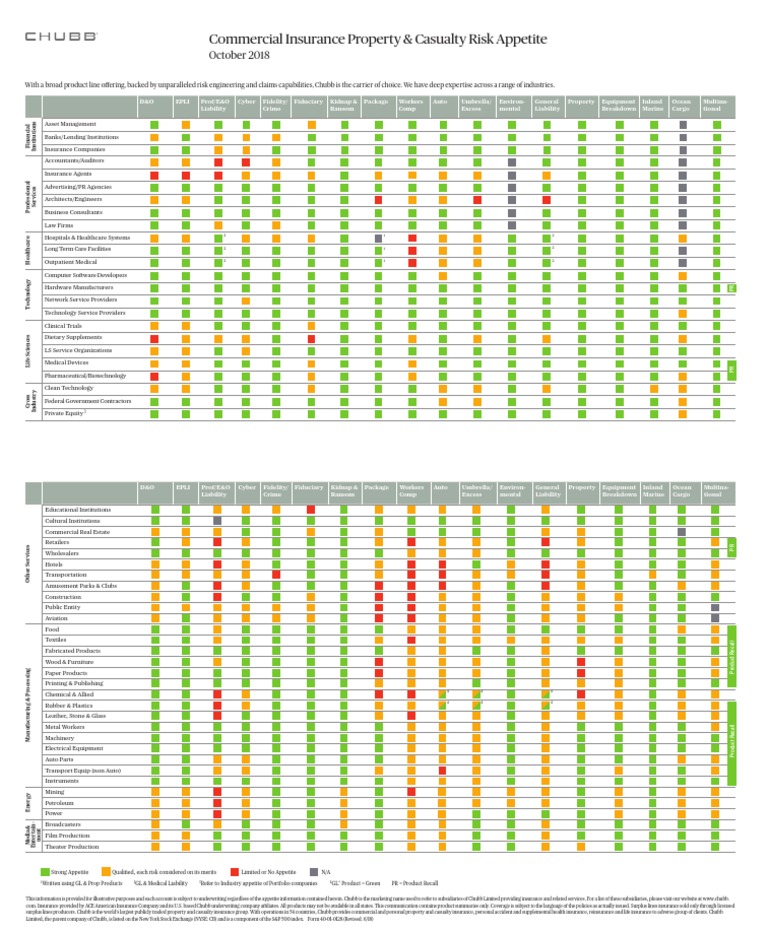

Key Factors Influencing Insurance Appetite. Several factors influence an insurer’s appetite for risk. These include: Industry: Insurers often specialize in specific industries, such as construction, healthcare, or technology. Their appetite will be stronger for businesses within their area of expertise. Geography: Geographic location plays a significant function, as insurers may have a greater appetite for risks in regions where they have a strong presence or understanding of local conditions. Size of Business: The size and revenue of a business can impact appetite, with some insurers focusing on small businesses while others target larger corporations. Risk Management Practices: Insurers assess the risk management practices of potential clients. Businesses with robust safety protocols and risk mitigation strategies are generally more attractive. Claims History: A clean claims history is a major plus. Insurers are wary of businesses with a history of frequent or large claims. Understanding these factors will help you narrow down your search and focus on insurers with a compatible appetite.

determineing Your Own Risk Profile. Before you can effectively target insurers with a matching appetite, you need a clear understanding of your own risk profile. This involves a thorough assessment of your business operations, potential liabilities, and risk management practices. Consider the following: Industry-Specific Risks: What are the unique risks associated with your industry? For example, a construction company faces risks related to worker safety, equipment damage, and project delays. Potential Liabilities: What are the potential liabilities your business could face? This could include product liability, professional negligence, or environmental damage. Risk Management Practices: What measures do you have in place to mitigate these risks? This could include safety training, quality control procedures, and cybersecurity protocols. By conducting a thorough risk assessment, you can create a detailed profile that accurately reflects your business’s risk exposure. This profile will serve as a valuable tool when studying and approaching potential insurers.

Utilizing Resources to Find the Right Fit. Finding insurers with a compatible appetite requires study and strategic networking. Here are some valuable resources to leverage: Insurance Brokers: Insurance brokers are experts in the insurance industry and can help you determine insurers with an appetite for your specific risks. They have access to a wide scope of insurance products and can offer valuable insights into the industry. Industry Associations: Industry associations often have relationships with insurers who specialize in serving their members. These associations can be a great source of referrals and information. Online Databases: Several online databases offer information on insurance companies and their areas of expertise. These databases can help you determine potential insurers and study their appetite. Insurer Websites: Many insurers publish information on their websites about their target industrys and areas of expertise. Reviewing these websites can offer valuable insights into their appetite. By utilizing these resources, you can significantly boost your chances of finding an insurer that is a good fit for your business.

Related Post : cit bank insured

Tailoring Your Approach: Presenting Your Business Effectively. Once you’ve identified potential insurers, it’s crucial to tailor your approach to highlight the facets of your business that align with their appetite. This involves: Emphasizing Risk Management: Showcase your robust risk management practices and demonstrate your commitment to safety and loss prevention. Providing Detailed Information: Be prepared to offer detailed information about your business operations, financial performance, and claims history. Highlighting Strengths: Emphasize the strengths of your business and how they mitigate potential risks. For example, if you have a highly skilled workforce or a state-of-the-art facility, be sure to highlight these assets. Being Transparent: Be honest and transparent about your business’s risks and challenges. Insurers appreciate honesty and are more likely to work with businesses that are upfront about their potential liabilities. By tailoring your approach and presenting your business in a positive light, you can boost your chances of securing favorable insurance coverage.

Navigating the world of insurance appetite can feel like traversing a complex maze. However, by understanding the key elements, utilizing available resources, and continuously refining your approach, you can effectively target the right insurance offerrs for your specific needs. Remember, a well-defined understanding of your risk profile, coupled with a strategic approach to determineing compatible appetites, is the key to securing optimal insurance coverage. So, take the time to study, analyze, and adapt your plan, and you’ll be well on your way to insurance achievement!